can i withdraw from my 457 without penalty

ROTH is good because you are financing your future with an option for college funds you cant get a loan for retirement but you can for. Brett if your 457 is a 457b then you should be able to withdraw funds without any penalty once you separate service from your department.

The Smartest Strategy To Saving Huge Stacks Of Money

Most 401 k plans allow for penalty-free withdrawals starting at age 55.

. You can withdraw the contributions at any age penalty-free. However even with the flexible. If you are impacted by COVID-19.

Unlike other retirement plans participants can withdraw funds before. Money saved in a 457 plan is designed for retirement but unlike. You are probably better off starting a ROTH or 529.

Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59. You can contribute an additional 6000 if you have a governmental 457 plan. You will however owe income tax on all.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. CARES Act withdrawal With the passage of the CARES Act in early 2020 there is a new option available for 401k withdrawal without penalty. Withdrawing Funds Between Ages 55 and 59 12.

Early Withdrawals from a 457 Plan. That is the benefit of a traditional. Unlike other retirement plans under the IRC 457 participants can withdraw funds before the age of 59½ as long as you either leave your employer or have a qualifying hardship.

Also the IRS does not place age restrictions on when you can withdraw Roth IRA contributions. You must have left your job no earlier than the. For instance if a local government.

Funds are withdrawn from an employees income without being taxed and are only taxed upon withdrawal which is typically at. Try to spend your entire 529 plan funds or save leftover funds for a beneficiarys further schooling graduate school or transfer the beneficiary to another child or family. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

COVID-19-related distributions will indeed be permitted for 403 b and governmental 457 b plans under the CARES Act legislation signed by President Donald Trump. A 457 plan is a type of tax deferred retirement plan and is similar to a 401k or 403b plan. You will however owe income tax on all withdrawals regardless of your.

A 457 plan is a tax-deferred retirement savings plan. However if a government employer does make a contribution to a 457 b plan it counts toward the total allowable limit for the year. Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59 ½ once you leave the company.

Although you wont pay a 10 percent penalty on early withdrawals you will find that 457b withdrawal rules require that you pay taxes on the amount at the time you withdraw it.

Can You Withdraw From Retirement Accounts For Education Disabilities Health Care Financial Planning Retirement Accounts College Expenses How To Plan

/young-entrepreneur-presenting-project-in-exclusive-boardroom-969223768-c4075b70a53f4330813d7592a6a98350.jpg)

Benefits Of Deferred Compensation Plans

How To Roll Over A 401 K From An Old Job Nextadvisor With Time

4 Strategies To Limit Required Minimum Distributions Rmds

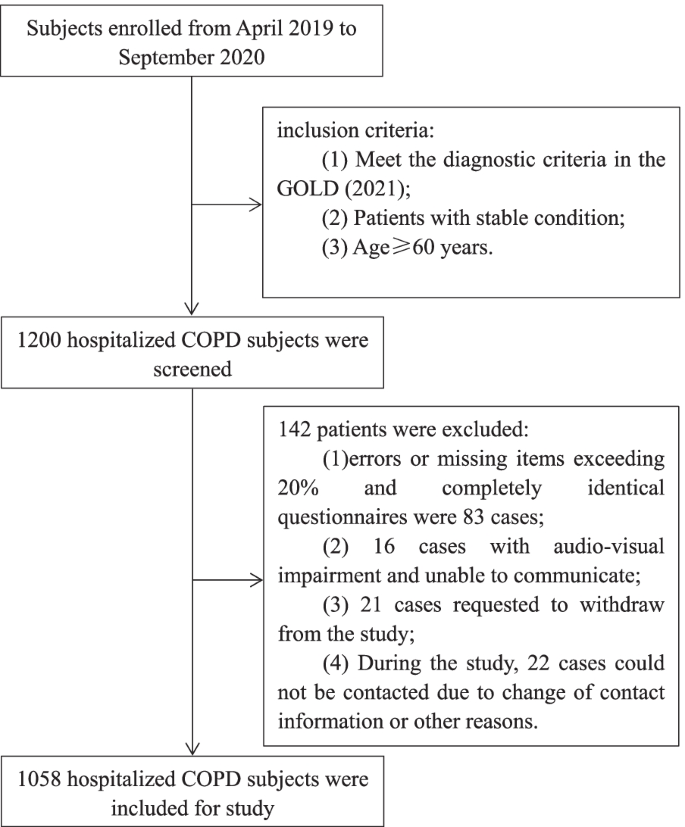

Prediction Of 30 Day Risk Of Acute Exacerbation Of Readmission In Elderly Patients With Copd Based On Support Vector Machine Model Bmc Pulmonary Medicine Full Text

Answers To Five Of The Most Popular Retirement Savings Questions T Rowe Price

How To Pay Those Upcoming College Bills

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

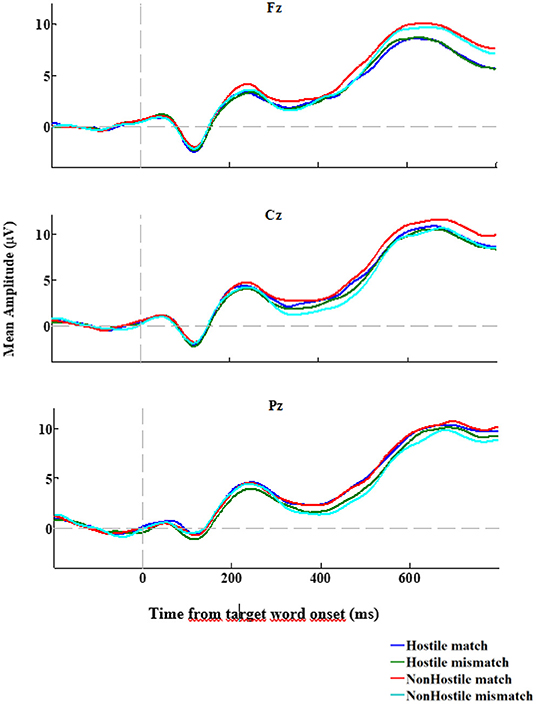

Frontiers Cognitive Control Processes And Defense Mechanisms That Influence Aggressive Reactions Toward An Integration Of Socio Cognitive And Psychodynamic Models Of Aggression

Breaking The Grip Obstacles To Justice For Paramilitary Mafias In Colombia Hrw